Help for New York Health Consumers

Since passage of the Affordable Care Act, New York State has cut its uninsured rate in half from 10% to only 5% through the successful implementation of the New York State of Health Marketplace and investment in local Navigator organizations who provide in-person enrollment assistance to hard-to-reach communities.

Yet, for many New Yorkers having an insurance card has not translated into better access to care because of the incredibly complex and confusing rules governing their insurance policies and affordability issues.

They often do not have the benefit of a workplace “HR” department to assist them when a problem arises with their health insurance.

New Yorkers need help understanding and using their health insurance

New Yorkers need help understanding and using their health insurance

A 2014 Kaiser Family Foundation survey of thousands of Navigator/Assistor programs found that 80% reported that enrollees returned for additional, post-enrollment insurance assistance. Navigators in New York corroborate that they see high numbers of returning clients who, after successfully enrolling, seek additional help with issues such as finding in-network providers, requesting plan cards, resolving billing issues, or understanding communications from their plans. Both the newly covered and those who have been covered for years need help understanding insurance concepts like deductibles, co-payments, co-insurance, maximum out-of-pocket costs; and filing complaints and appealing plan decisions.

New Yorkers are having trouble paying for care.

New Yorkers are having trouble paying for care.

Insurance company and medical billing practices often leave consumers vulnerable to medical bills that can wreak financial havoc in their lives. According to a survey conducted by The New York Times and the Kaiser Family Foundation in 2016, 62 % of people with medical bill problems had insurance. And in a 2019 survey of New York health consumers, 52% said they struggled paying for healthcare within the past year.

More funding is needed for post-enrollment assistance

More funding is needed for post-enrollment assistance

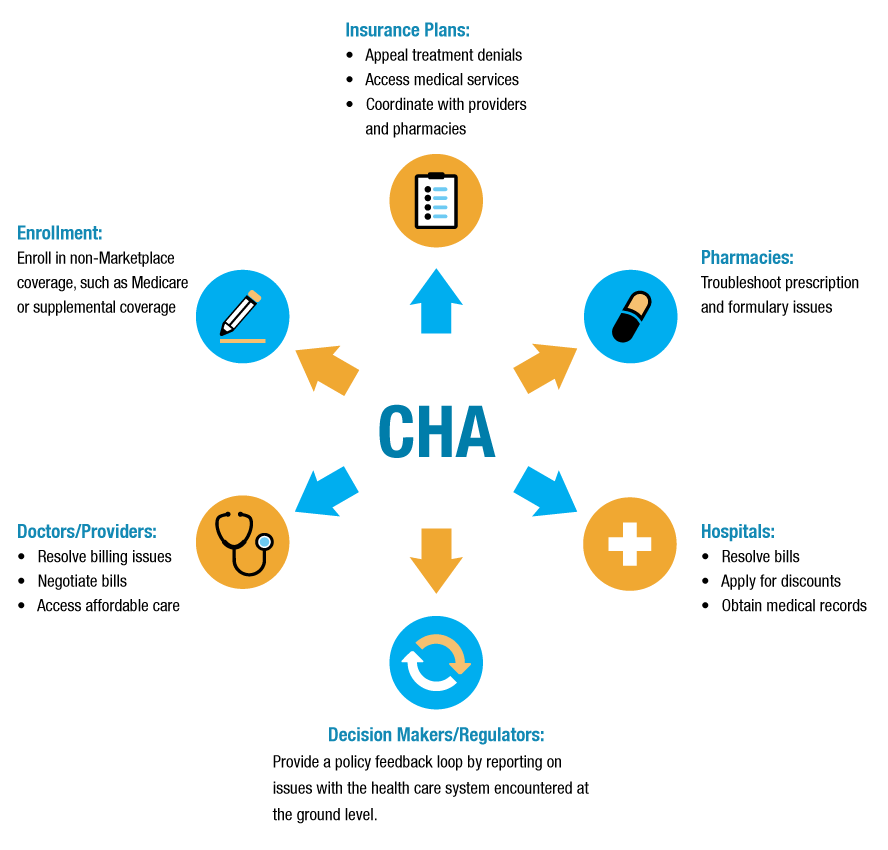

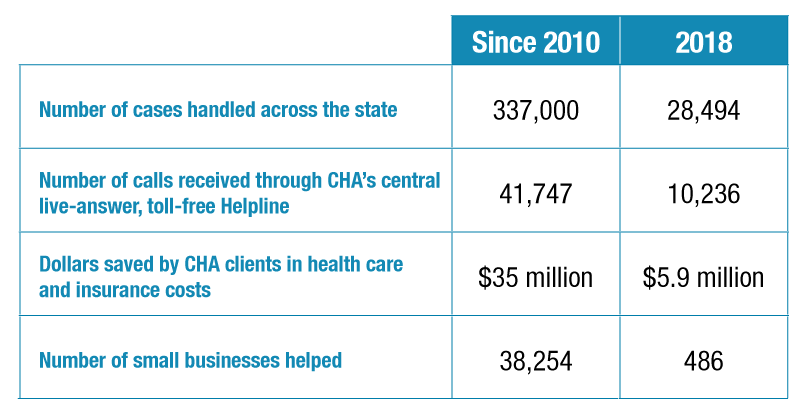

Community Health Advocates (CHA), the state’s Consumer Assistance Program, helps 30,000 New Yorkers every year navigate the healthcare system and their insurance through a central live-answer, toll-free helpline and a network of 30 community-based organizations and small business serving groups serving all 62 counties of New York. The helpline serves approximately 10,000 callers each year and handles complex commercial insurance coverage appeals of denials of care and payment of medical bills. The program has saved New Yorkers $35 million to date in health insurance and healthcare related costs.

CHA’s helpline is listed on all commercial insurance carriers’ Explanations of Benefits and claim denials. But CHA’s helpline number is not listed on Medicaid Managed Care notices when a benefit is denied. This means that there are currently more than 4 million low-income New Yorkers enrolled in Medicaid Managed Care plans who may not find out about CHA’s services when they most need them.

Community Health Advocates (CHA) is a statewide network of organizations that help individuals, families, and small businesses use their health insurance and obtain the health care they need.

CHA’s network consists of 30 partner organizations, including three specialists (Empire Justice Center, The Legal Aid Society, and Medicare Rights Center) that provide training and technical assistance. Our partners include immigrant advocacy organizations, social service organizations, chambers of commerce, and small business development groups. CHA’s toll-free, live-answer Helpline is available Monday through Friday, 9 a.m. to 4 p.m., to help consumers use their health insurance, dispute insurance denials, address billing issues, and otherwise access healthcare.

CHA and its partners have the cultural and linguistic expertise needed to address the health care issues facing New York’s diverse communities. We offer services in multiple languages and provide hands-on assistance in urban, suburban, and rural communities.

CHA offers free assistance to all health care consumers, whether they have health insurance or not. We offer the same services to all New Yorkers, regardless of their immigration, medical, or income status.

Insurance Plan Wouldn’t Allow Devin to Get Special Formula for His Allergies. CHA Fixed It.

Nothing helped Devin’s violent allergic attacks until the doctor prescribed an expensive prescription formula. The formula worked like magic. “Devin immediately had more energy,” said his mother. “He put on weight and the vomiting decreased.” Their insurance company insisted the formula wasn’t medically necessary, however, and said the family had to pay out of pocket, nearly $1,000 a month.

CHA helped Devin’s family submit an appeal that demonstrated that the formula was medically necessary. The shrewd guidance from Devin’s CHA Advocate resulted in a reversal of the denial and full coverage for the formula.

CHA Helps Consumers Appeal Insurance Company Denials

Paola’s intrauterine device (IUD) became embedded in her uterus, posing a health risk. The removal procedure required an ultrasound. Her plan paid for some of the cost but said that ultrasounds were covered only for fertility treatment, not for contraceptive care.

CHA argued that the ultrasound was medically necessary in order to safely remove the embedded IUD and should be covered. After nearly five months, the plan reversed its denial and approved full payment, saving Paola nearly $2,700.